In recent weeks on social media there seems to have been a lot of comment and debate about founders and investors. Interestingly a great deal of it appears almost adversarial as if both parties are working against each other rather than seeking a mutual benefit. Some of this is I guess due to poor behaviour on either side. Founders perhaps feeling disappointed or even betrayed by potential investors and investors feeling frustrated by the quality over the ask from founders.

Many Angel investors I think like the idea and image of being an Angel. I know a great number who have never invested a significant sum in any business, but they still use the title. That doesn’t really bother me, many of them are really waiting for the very best opportunity they can get and provide useful feedback to founders who present to them. Some are of course just a waste of time, but that’s true in any industry.

So, let me share with you who I am as an investor and in truth I think I’m pretty typical. Firstly, I may not look it but I’m old, there, the first admission of this piece. But with age I would hope comes wisdom. People pay me for advice, and they keep coming back so I must know something. I have built and sold more than one business, but I’m a long way from becoming a billionaire.

I belong to three Angel syndicates, one of which is very small and very selective, and it’s made up of myself and two other friends. We tend to evaluate new businesses together using our experience and we do invest typically sums of about 100,000 pounds. But we are a hard audience, and we respect and trust each other’s views totally. Generally, unless we all agree then none of us will invest.

The other two Angel syndicates I belong to are more formal and are run as businesses. In these my investment decisions are my own but of course after the pitches are complete, we all do discuss and feedback our views to the founders who have presented. The people who make up these syndicates come from varying backgrounds, some like me are founders who have had successful exits. Some are simply wealthy individuals; some even represent businesses who are looking for both investment and even for potential future acquisitions. But we are all individuals with our own histories, biases and likes. We come to trust each other and our judgments and because of this if you were a founder and you know an Angel investor in one of these syndicates their recommendation for you to pitch to them is very valuable, you come to that day with a sponsor. But you will never obtain that simply by ‘cold calling’ angels, we have our own reputation to maintain. I am no different, I spent a long time building my reputation in the industry and I will not recommend or introduce a founder to any syndicate that I belong to unless they meet two criteria. Firstly, that I am already invested or committed to invest in that business and secondly that the Angel syndicate is right for that founder. Putting it simply it’s like a job interview, I won’t put a candidate forward unless I believe in them, and they have a high chance of success.

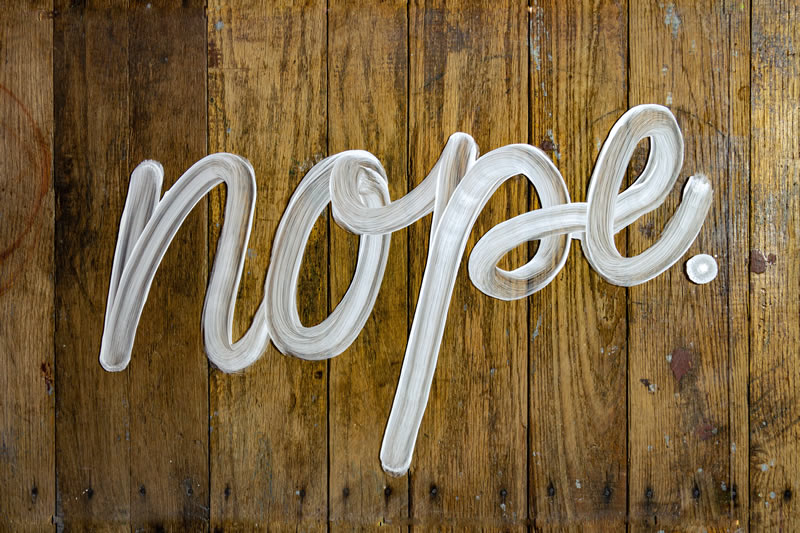

The next point may shock you. I admit when I first see a proposal or pitch from a founder my starting answer is no, I will not invest. I don’t listen to proposals with an open mind. I am cynical I want to say no. I do this because for me personally if you can change my mind it will be because you have what I feel is an unbeatable offering that will transform any investment I make into much greater sum. Few angels will probably admit to this position, but I suspect many do share it, so when the questions you get as a founder appear to be trying to reinforce a negative position they probably are. Remember investors are individuals, they are a sophisticated form of buyer and that’s the industry I came from. I’m also famous amongst the people who worked with me, and for me, for being able to change my mind, to be convinced, to be challenged, to be proven wrong and to never bear a grudge when I am. That is one of the traits of a good leader, they listen, they understand, and they work with you. So, if you are presenting to me don’t feel I’m wasting your time if I appear to be biased, because I am. The one agreement we had made with each other is to spend some of our time together, and remember that’s valuable, it’s something you will never get back I respect that of you, so please do the same for me.

The other thing about me is I am an active investor. This means that unless I can bring something of value to your business I certainly won’t invest. It’s one of the reasons I am especially interested in tech businesses. If you read my LinkedIn profile you will see my history. That will tell you where I can add value to your business. If I can’t then just because I’m an Angel investor doesn’t mean I would even listen to your idea, I have never invested in a business outside of my comfort zone that I could not bring something to. So now we know how not to waste each other’s time.

When I do invest it is typically a sum between 25,000 and 50,000 pounds, so don’t waste your time or mine if your entry ticket price is more than this. I expect to follow on that investment at least once and then if you are successful to accept the dilution of my share ownership which follows as your business grows and needs larger funds.

If you do not have a plan to exit your business in some way and can show me how you can multiply my investment in this way, then do not approach me. I am investing in you and taking the risks associated with it for a return. I’m not interested in investing in lifestyle businesses, although I appreciate many people are very happy running them and I applaud that. They simply don’t give me a big enough return if any at all.

When I meet you and you present to me, I treat it like I am employing you. I spent many years in industry before starting businesses selecting and interviewing employees. I’m proud to say that almost all people I employed were successes and almost all have gone on to achieve much bigger things. That greatly pleases me. Be aware that when you present to me as a founder, I am asking myself a question, would I employ this person? When I review your founding team, I ask myself a slightly different but related question. Has the person presenting to me picked the right people? Have they chosen well? Are they capable of leading this team and making the hard decisions associated with that leadership role? Are they wise enough to recognise when they need help and do they know their own limitations? Will they be capable of releasing members of that founding team when the business grows too big for those members to continue to contribute?

I have never seen a founder or founding team answer those questions as part of their presentation, it’s counter intuitive of course. Why would you as a founder indicate that you or your team is anything but perfect? But know that I’m going to probe that aspect of your business from the very start simply because I know you will have to face those issues.

You may be asking yourself why I’ve written this post. Some of you will be wise enough to realise that this in itself is a test. If you are presenting to me, asking for investment and you have not read this then I will seriously question your capabilities and your likelihood of getting investment from me will be low. After all you are selling something, you are selling an idea and I’m the buyer. You can see now how I treat my investment decisions and how I see you as a founder. If you were a salesperson and had not researched the buyer you were selling to you would be remiss in your duty, you would have far less chance of a successful sale. By researching the potential investors you are talking to properly, your chances of success multiply. The temptation when you are fund raising is to get to as many people as possible, if you have the time to do that whilst researching who they are then great, but I suspect you won’t.